(Approx: 7 min read)

A statutory (legally required to be provided) warranty comes with all new and some second-hand cars… but it doesn’t last forever. So, what happens when it runs out and how does it affect you, the car’s owner?

Key facts at a glance:

- New cars in the UK come with a manufacturer’s warranty, which is a form of statutory warranty. It typically lasts for three years or 60,000 miles, whichever comes first. It covers manufacturing defects, errors, and faults.

- The Consumer Rights Act 2015 requires a statutory warranty be placed on all used cars bought from a dealer. This is to ensure vehicles are of satisfactory quality, fit for purpose, and as-described.

- If a fault develops within 30 days of purchase from a dealer, buyers can return the car and receive a refund.

- If a fault develops between 30 days and six months, the law assumes the issue was present at purchase. The dealer gets one chance to fix it, or the buyer can request a refund (which may be a reduced figure to reflect usage).

- After six months, buyers must prove the fault existed at the time of purchase from the dealer to claim for the repair.

- Statutory warranties only apply to cars bought new or used from dealers — not private sales or (most) auctions.

- To check your warranty status, you can review your purchase documents, check the manufacturer’s website, contact a dealership with the vehicle’s VIN (Vehicle Identification) number, check the odometer, review service records, or check your registration/insurance documents.

- Once out of warranty, all repair costs are the owner’s responsibility.

- Cars out of warranty may have lower resale value, and owners must plan financially for unexpected repairs, with average repair bills on UK vehicles around £600 and rising.

- Extended warranties or service contracts can provide additional peace of mind. They can also increase resale value by offering comprehensive coverage and benefits such as emergency breakdown assistance.

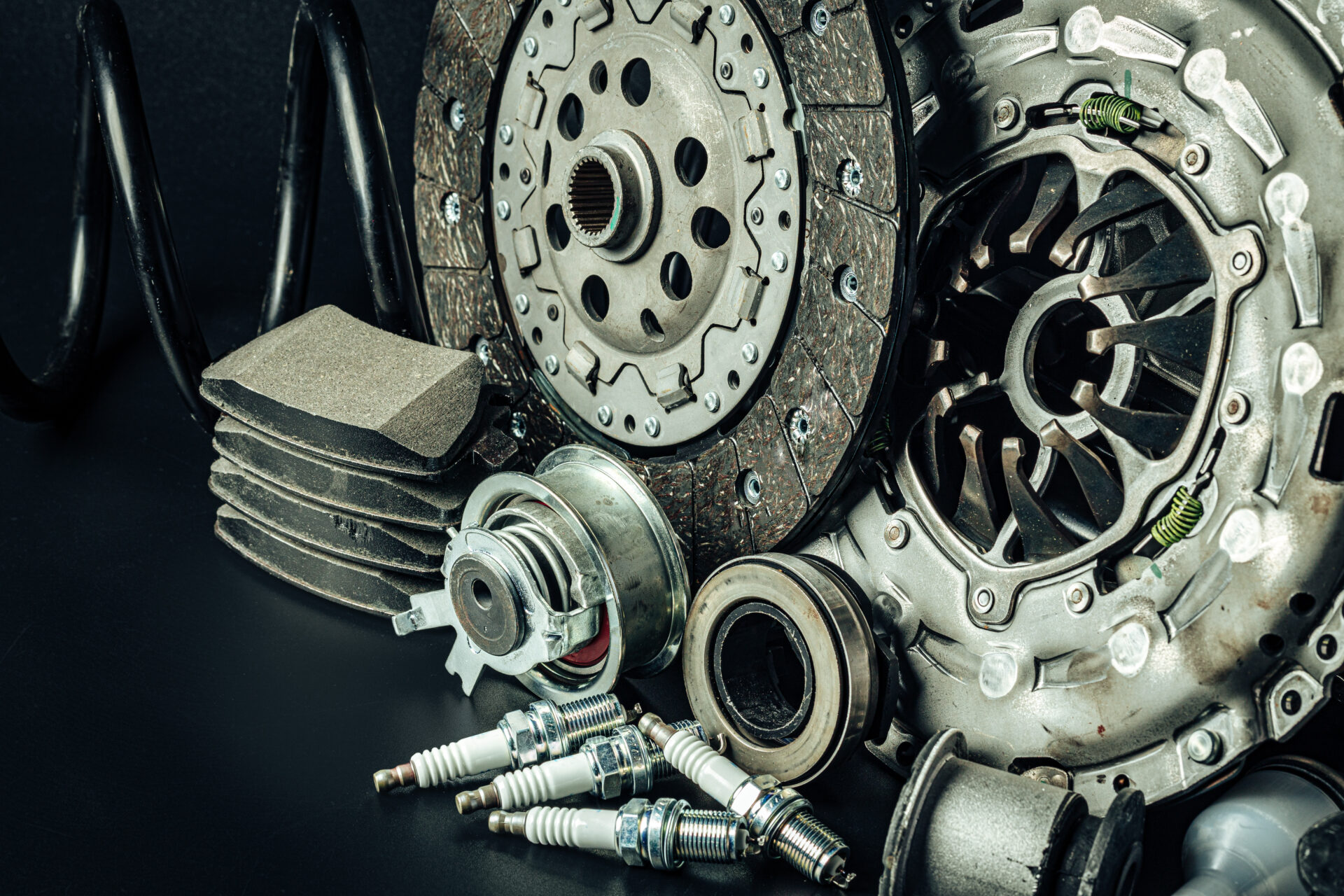

- OEM (original equipment manufacturer) parts are recommended for safety and to maintain value. Extended warranties often use these for repairs.

- Roadside assistance, car hire and onward travel expenses are other key benefits of extended warranties. These reduce stress and support worry-free motoring.

- Warrantywise offers extended warranties with 24/7 breakdown cover. With over 25 years of experience, we provide the UK’s best used car warranty product.

Is there a statutory warranty on used cars?

Since 2015, anyone buying a used car has been protected by the Consumer Rights Act. This ensures a statutory (legally required) warranty to be placed on second-hand cars bought from a dealer.

If you buy a used car and it develops a problem after 30 days, but before six months from the date you bought it, the law thinks the problem was there from the start.

Unless the seller can show it wasn’t, your car is protected by its statutory warranty and the seller will get one go at fixing the issue. If they can’t fix it, you can ask for your money back.

However, the money returned might be less than what you paid, to reflect the time you were able to use the car.

After six months, the automatic protection of the Consumer Rights Act expires. After this point, it’s up to the buyer to prove that there was a fault with the car at the time of purchase if they want to pursue a seller to repair a fault.

How can you check if your vehicle is out of statutory warranty?

- Review your vehicle purchase documents: The easiest way to check if your car still under statutory warranty is to look at the purchase documents/warranty booklet provided when you bought the car. These documents should outline the warranty’s duration/expiry date.

- Check the manufacturer’s website: Many car manufacturers offer an online tool you can use to enter your vehicle’s VIN (Vehicle Identification Number, sometimes called a ‘chassis number’) to check on its warranty status.

- Contact a dealership: You can also call or visit an authorised dealership that sells your car’s brand. Provide them with your VIN and they can look up the warranty status of your vehicle.

- Check the odometer / mileometer: Most car warranties are limited by either a number of years or number of miles, whichever comes first. If you know the original warranty terms, you can simply check the car’s odometer (mile counter) to see if you’ve exceeded the mileage limit.

- Review service records: If you have or have kept detailed service records, these may indicate any previous claims made on any warranty. These could provide clues about the warranty period and if it is still in effect.

- Check registration/insurance documents: Sometimes, the effective period of a car’s warranty are noted in its registration or insurance paperwork.

Why does it matter if your vehicle is out of statutory warranty?

The following outlines key issues related to your car being out of warranty:

![]()

Repair costs

All repair costs fall to you. No protection for defects or malfunctions related to manufacturing. If something goes wrong it’s down to you to arrange and pay for all repairs regardless of the cost.

![]()

Maintenance

You must proactively organise and pay for maintenance. You can choose any service provider for maintenance, not just authorised dealerships, potentially reducing costs. Regular servicing of your vehicle is essential to highlight any issues and avoid expensive repairs.

![]()

Resale value

If your car is out of warranty, it might have a lower resale value as buyers consider future repair and maintenance costs.

![]()

Insurance rates

Out of warranty status doesn’t directly affect insurance rates, but comprehensive coverage becomes more important for older cars.

![]()

Depreciation

Your car may depreciate faster after the warranty expires, as the market values cars with active warranties more highly.

![]()

Peace of mind

Having a warranty gives you peace of mind and the security of knowing that major defects on your car will be repaired at no cost. Without this, stress and worry can increase for some vehicle owners.

Repair costs:

One of the most immediate impacts of an expired statutory car warranty is the added cost to you, the car’s owner.

Car repairs can be very expensive and without a warranty these costs will have to be paid out of your own pocket. This can be a significant financial burden, especially if major components like the engine or transmission need repairs [1].

The average bill for an unexpected car repair is close to £600. However, this can be much higher for premium brands such as Audi, Mercedes and BMW. This, alongside the fact the cost of vehicle repairs is set to soar to an ‘all-time-high’ in 2025, [1] means costs are a larger consideration for drivers than ever.

Maintenance:

Once your warranty expires, you are responsible for arranging and paying for any repairs and maintenance. This includes finding a reputable garage and ensuring work is done correctly.

In the UK, all garages are required to carry out work with reasonable care and skill under the Consumer Rights Act 2015. If something goes wrong with their workmanship, you can make a claim under your legal rights [2].

Parts expense:

Whilst using cheaper, non-genuine parts to perform repairs can be tempting, it can end up costing you more in the long run. They affect your manufacturer’s warranty and decrease the resale value of your car.

However, the most important reason for using genuine (OEM) parts is to ensure the safety features of your vehicle will perform as reliably as possible in the event of an accident.

An extended warranty will recommend using OEM parts for repairs and replacing them in pairs where necessary. This is to avoid any future issues with consequential failures.

Resale value:

A car with an expired warranty could have a lower resale value than a similar car with a valid warranty.

While there is no specific figure available on how much an extended warranty adds to the resale value of a car in the UK, it’s likely to give potential buyers added confidence in the vehicle’s condition.

This can make them willing to pay a higher price for the car, especially if the warranty offers comprehensive coverage and is transferable to subsequent owners.

Peace of mind:

Nothing beats the peace of mind of knowing that, should anything happen to your vehicle, you’ll be able to get it fixed quickly – at no cost – with little impact your daily life.

An extended warranty plan can offer roadside assistance and recovery, car hire and onward travel and expenses. This takes away some of the pressure of an unexpected vehicle breakdown.

Extended warranty:

An extended warranty from a third party provider will help to protect you from the unnecessary costs associated with urgent repairs and breakdowns when your car runs out of its statutory warranty.

Extended warranties also offer added value aside from just repairs. These include managing the whole repairs process from start to finish, breakdown cover and also a hire car (if required). This can work out a lot cheaper than holding specific policies for each.

Financial planning:

Not having a warranty on your vehicle means you’ll probably need put money aside, just in case something unexpected happens.

With average repair costs at £600 or more, you’ll need to balance how much you can sensibly save against having a warranty that will cover major mechanical and electrical repairs.

Get an extended warranty you can be confident in with Warrantywise:

Warrantywise offers an extended warranty you can be confident in. It includes 24/7 breakdown cover, car hire and onward travel expenses as standard.

With over 25 years of industry experience, we do all the hard work so you can stay in the driver’s seat.

Protect your vehicle with the UK’s best used car warranty from Warrantywise for complete peace of mind and worry-free motoring.

For a quick quote or more information, visit our Car Warranty page.

Note: The information provided is for general informational purposes only and does not constitute legal, financial, or professional advice.